Riverside Public Library Eliminates Fees

As of January 17th, 2023, the City of Riverside’s public library system will no longer be charging fines for overdue materials to library card holders. The elimination of overdue fees for library materials including books, audiobooks, CDs, and DVDs is a new trend in cities throughout the nation. Not only are new fines not being charged, but old fines have been wiped from the system. This is great news for all library patrons in our city.

Why is this happening? There are numerous reasons for the removal of library fees. The most significant is that studies have shown that fines create unequal barriers to library access within the communities served. When customers receive a late fee, they are less likely to come back to the library. Rather, they just avoid going and as a result, the library is less likely to retrieve the overdue item. We all know that the fees can creep up on us. That $0.25 per day can add up fast when a library book is left under a bed or couch and does not get returned.

Going to the library is meant to be a positive experience, bringing learning and joy into families’ lives. Libraries across the country are finding that the fines drive away people who stand to benefit the most from the free library resources. Studies have shown that late fees on cardholders disproportionately deter low-income residents and children from using the library. According to a report presented to the Mayor and City Council from Riverside’s Board of Library Trustees, A win, win for everyone involved.

“Eliminating fees reduces patron guilt in returning materials, helps foster a better library environment, produces friendlier interactions between library staff and customers, and allows staff to focus on transformational customer experiences rather than transactional ones.”

The elimination of fines should not have a great financial impact on the library system as they do not rely on fines as a major source of revenue. The fiscal impact of the fines is estimated to be around $5,000 over the next couple of years. The loss of revenue will be offset in part by the reduced administrative time and effort required to track late materials.

The City of Riverside has 8 libraries situated throughout the city. Check out your local library today in person or online at the Riverside Public Library website.

Pets & 4th of July: A Tenuous Relationship

Make Sure You Are Ready

The July Fourth holiday is almost here. This holiday is one for celebration but is also one for preparation. Take the time now to prepare yourself, your pet, and your house to keep everyone safe, secure, and at home. Charlotte is a past board member of the Mary S. Roberts Pet Adoption Center and this time of year was always a busy time. Not only does it take place at the peak of the kitten season, but it is also a time when frightened dogs suddenly appear. We received an email from Mary S. Roberts Pet Adoption Center with some really helpful tips to make sure that our furry friends stay safe. We thought we would share it with you.

Fireworks and the loud noises associated with the celebrations frighten dogs especially. These scared dogs will sometimes jump fences, or bolt out of fear, stress, or confusion. Unfortunately, shelters see a large uptick of lost pets immediately following the July Fourth holiday. Prevent your pet from being lost by following the below steps.

- Make sure your pet is microchipped! Check that the contact information connected to the chip is up to date. Microchipping is permanent pet identification. The process is safe, simple, and designed to quickly identify lost posts so that they can be reunited with their owners. It’s not too late to get your pet microchipped. Visit the MSRPAC weekly Vaccination Clinic, every Saturday from 9am – 1pm for low-cost vaccines and microchips that cost only $21.

- Don’t forget about collars and tags! Be sure your pet is always wearing its collar and I.D. tags. Take an extra minute to double-check that your contact information is up to date and visible on the I.D. tags. If you aren’t able to secure tags before the holiday, as a temporary fix, you can write your phone number on your pet’s collar with a permanent marker.

- Consult your veterinarian for pets with anxiety. Now is the time to call your veterinarian’s office and make an appointment to talk about remedies available that may lower your pet’s stress level.

- Create a home sanctuary. When scared, some pets may become destructive, so be sure to remove anything from reach that could become damaged or harm your pet if chewed or eaten. Leave your pet secured in a low-traffic area of your home where they are safe, comfortable, and sheltered from outside noise and lights.

- Make plans early for a pet sitter! If you won’t be home during the July Fourth celebrations, consider finding someone to watch your pet. Having company can help pets stay calm and ensure they don’t become lost.

Thank you to the Mary S. Roberts Pet Adoption Center for helping us to make sure that our pets are safe during these summer weeks while the loud noises might scare our furry friends. If you have additional questions or need more information about where to best find resources to make sure your pets are safe, feel free to reach out to The Ransom-McKenzie Team for help. We love our fur babies and would welcome the opportunity to help you keep your pets safe.

Is the Housing Market Correcting?

If you’re following the news, all of the headlines about conditions in the current housing market may leave you with more questions than answers. Is the boom over? Is the market crashing or correcting? Here’s what you need to know.

The housing market is moderating compared to the last two years, but what everyone needs to remember is that the past two years were record-breaking in nearly every way. Record-low mortgage rates and millennials reaching peak homebuying years led to an influx of buyer demand. At the same time, there weren’t enough homes available to purchase thanks to many years of underbuilding and sellers who held off on listing their homes due to the health crisis.

This combination led to record-high demand and record-low supply, and that wasn’t going to be sustainable for the long term. The latest data shows early signs of a shift back to the market pace seen in the years leading up to the pandemic – not a crash nor a correction. As realtor.com says:

“The housing market is at a turning point. . . . We’re starting to see signs of a new direction, . . .”

Home Showings Then and Now

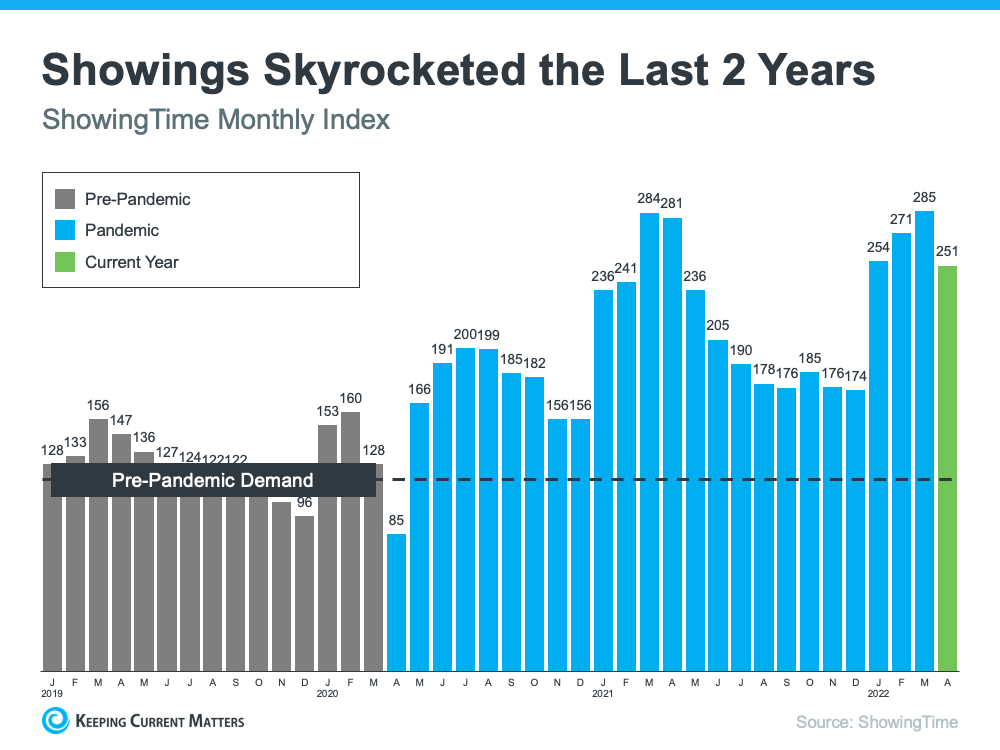

The ShowingTime Showing Index tracks the traffic of home showings according to agents and brokers. It’s a good indication of buyer demand. Here’s a look at that data going back to 2019 (see graph below):

The 2019 numbers give a good baseline of pre-pandemic demand (shown in gray). As the graph indicates, home showings skyrocketed during the pandemic (shown in blue). And while current buyer demand has begun to moderate slightly based on the latest data (shown in green), showings are still above 2019 levels.

And since 2019 was such a strong year for the housing market, this helps show that the market isn’t crashing – it’s just at a turning point that’s moving back toward more pre-pandemic levels.

Existing Home Sales Then and Now

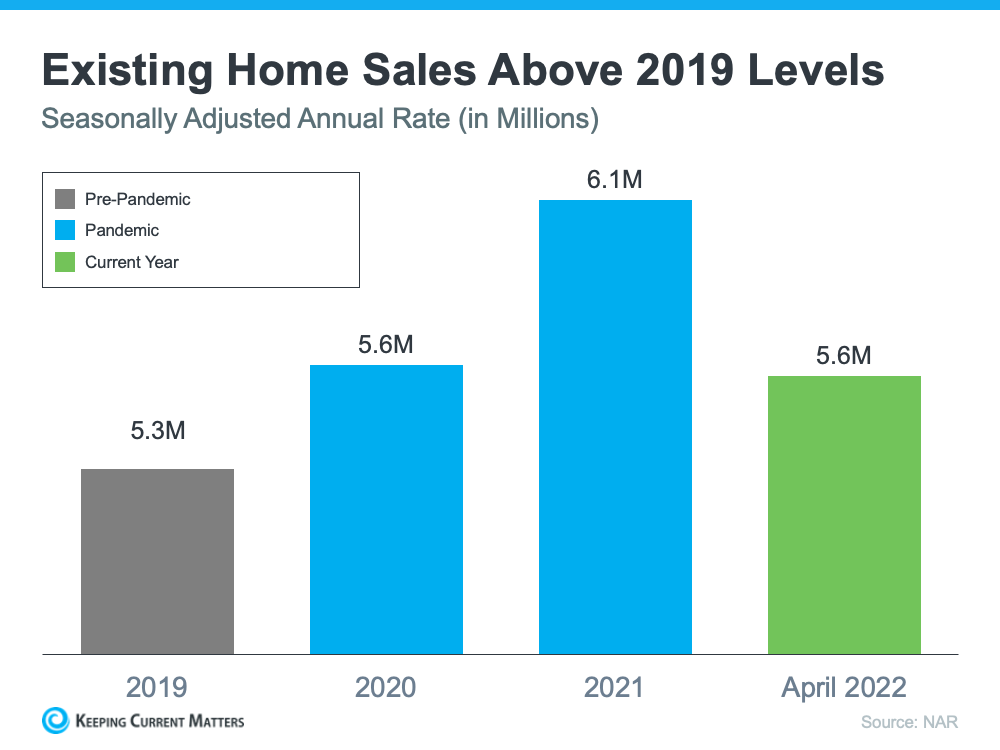

Headlines are also talking about how existing home sales are declining, but perspective matters. Here’s a look at existing home sales going all the way back to 2019 using data from the National Association of Realtors (NAR) (see graph below):

Again, a similar story emerges. The pandemic numbers (shown in blue) beat the more typical year of 2019 home sales (shown in gray). And according to the latest projections for 2022 (shown in green), the market is on pace to close this year with more home sales than 2019 as well.

It’s important to compare today not to the abnormal pandemic years, but to the most recent normal year to show the current housing market is still strong. First American sums it up like this:

“. . . today’s housing market looks a lot like the 2019 housing market, which was the strongest housing market in a decade at the time.”

Bottom Line

If recent headlines are generating any concerns, look at a more typical year for perspective. The current market is not a crash or correction. We have been explaining this to our sellers and buyers for over three months now. This is just a turning point toward more typical, pre-pandemic levels. Reach out to The Ransom-McKenzie Team if you have any questions about our local market and what it means for you when you buy or sell this year.

Put the River Back in Riverside

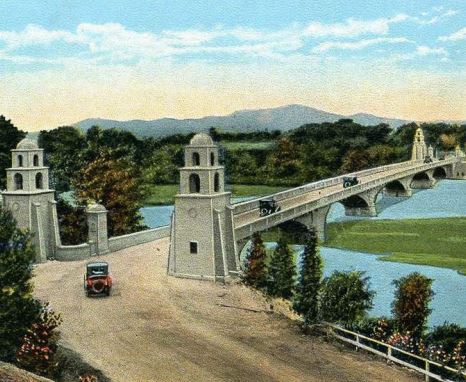

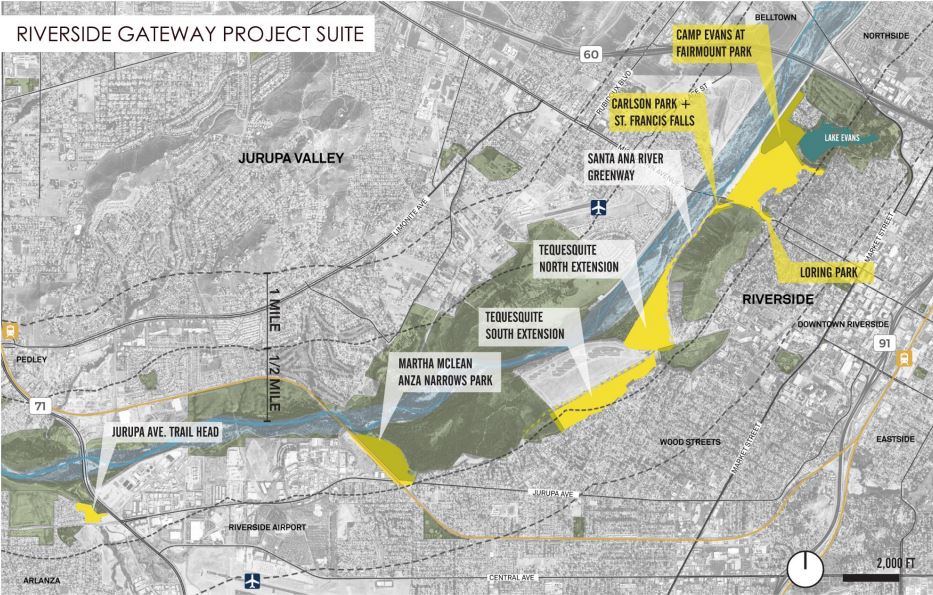

Riverside’s proximity to the Santa Ana River is the reason for its namesake. The impressive gateway to the city, originally built in 1923, is the Mission Bridge which extends over the river and up into the city through the Buena Vista Bridge. The significance of the Santa Ana River Watershed, which extends from the Pacific Coast to the San Bernardino Mountains, is sometimes lost to the residents of Riverside. Our city is blessed with a 10 mile stretch of land encompassing 250 acres of city-owned property along the Santa Ana River’s natural habitat.

Long before the city of Riverside was established, the watershed sustained regional indigenous tribes as well as diverse flora and fauna along its banks. Over the years, the beauty of the river has been lost and neglected as dams and channels changed its shape. It also became exploited for industrial and undesirable uses such as landfills. The city has lost touch with the river and is now actively looking to bring the river back into Riverside.

The Riverside Gateway Project Suite is a proposal to “recover, re-conceive, and re-engage” with the Santa Ana River. According to the City’s site analysis for the project, this presents “a phenomenal opportunity to resuscitate older interactional patterns between the city and river, while adapting those resources to modern life.” The project, which is funded in part by the State Coastal Conservancy, will focus on 8 locations which include current parks such as Martha Mclean Anza Narrows, Loring Park, Camp Evans at Fairmount Park, and Carlson Dog Park. These areas will incorporate existing structures such as the historic Saint Francis Falls at Carlson Park and augment them with new features such as research stations, sensitive area walkways, water play areas, and even reserved camping sites.

If you are interested in finding out more about what is being planned for the Riverside Gateway Parks system along the Santa Ana Riverbottom, Tune in tomorrow evening to participate in this virtual workshop. They will be presenting plans that are in the works and will be asking for community input. Here are the details.

PRCSD and the Riverside Gateway Parks Team have been working hard since our last virtual workshop in October, and we are excited to share Project updates with you and hear your feedback! The Riverside Gateway Parks project will develop Park Master Plans for sites along the Santa Ana River Trail in Riverside. Once complete, these sites will contribute to the Santa Ana River Parkway and Open Space system, a regional vision for a trail and greenway along the Santa Ana River. We invite you to connect on the second virtual workshop on Wednesday, February 2 from 6 – 7 p.m. If you would like to attend, please use the information below: Zoom Meeting https://us06web.zoom.us/j/84627232103 Meeting ID: 846 2723 2103 Passcode: 894995 The upcoming workshop will focus on two of the park sites, Martha McLean-Anza Narrows Park and the trailhead property at Van Buren Blvd. and Jurupa Ave. In addition to this workshop, we invite you to visit our website RiversideGatewayParks.com to learn more, fill out our survey, and provide comments on our interactive map. Please note the deadline for providing feedback for Martha McLean-Anza Narrows Park and the Jurupa Avenue Trailhead is Saturday, February 5 at 8 p.m. Help put the “river” back in Riverside! |

The Riverside Gateway Project Suite is part of a comprehensive effort by cities and counties along the Santa Ana River Watershed, orchestrated by the California State Coastal Conservancy. It is exciting to know that Riverside is an integral part of this revitalization, creating a string of parks along the river. This will be a “citywide park that provides places to find the peace and harmony of nature within or on the edges of the City’s urban fabric.”

Do We Buy Homes for our Pets?

We Love our Four Legged Friends!

You all know we love our dudes Natsu (#StoicNatsu) and Fuyu (#Fubear). It turns out, we are not alone. You might be surprised by how much of our lives are dictated by our pets’ wants and “needs”. Check out the infographic below from Keeping Current Matters to learn how they affect our home-buying decisions.

![A Happy Tail: Pets and the Homebuying Process [INFOGRAPHIC] | Keeping Current Matters](https://files.keepingcurrentmatters.com/wp-content/uploads/2021/12/08135556/20211210-NM.png)

Some Highlights

- It’s no secret that we love our furry friends – about 70% of U.S. households have pets. What may come as a surprise is how large a role they play in the homebuying process.

- Americans spend $1,163 a year on their pets, and nearly half of pet owners say they would move for better accommodations and amenities for their pets.

- If you’re thinking of adding a furry friend, or if you already have, give the Ransom-McKenzie Team a call to discuss how you can find a home that meets all your pet’s needs.

What’s Happening With Home Prices?

Many people have questions about home prices right now. How much have prices risen over the past 12 months? What’s happening with home values right now? What’s projected for next year? Here’s a look at the answers to all three of these questions.

How much have home values appreciated over the last 12 months?

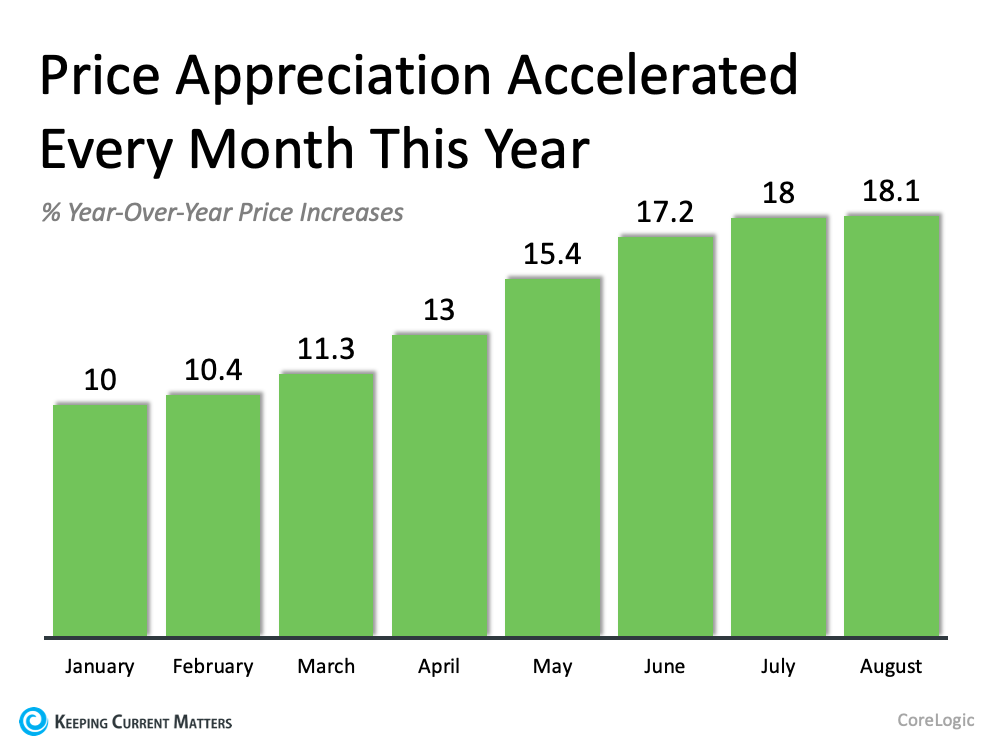

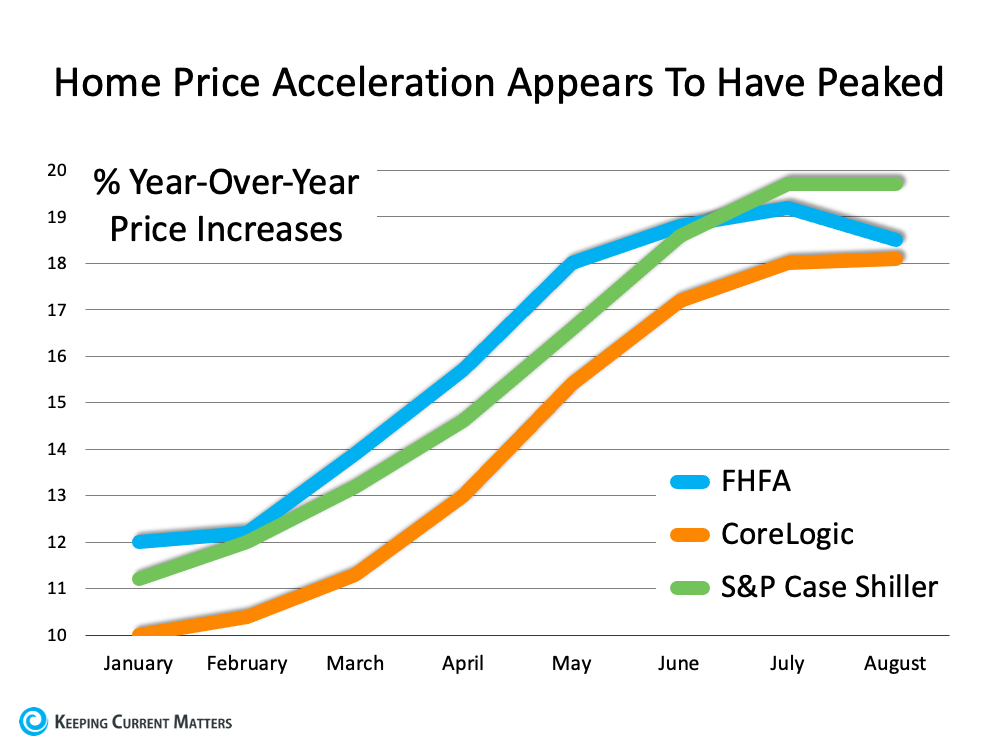

According to the latest Home Price Index from CoreLogic, national home values have increased by 18.1% compared to this time last year. In Riverside, we’ve seen a 20% increase YOY with our median sales price for October 2021 peaking at $575,000. Additionally, prices have gone up at an accelerated pace for each of the last eight months (see graph below). The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The last year has shown tremendous home price appreciation, which is resulting in a major gain in wealth for homeowners through rising equity.

What’s happening with home prices right now?

All three indices mentioned above also show that while appreciation is in the high double digits right now, that price acceleration is beginning to level off (see graph below). Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Keep in mind, that doesn’t mean home values will depreciate. It means the rate of appreciation will slow, yet stay well above the 25-year average of 5.1%.

What about next year?

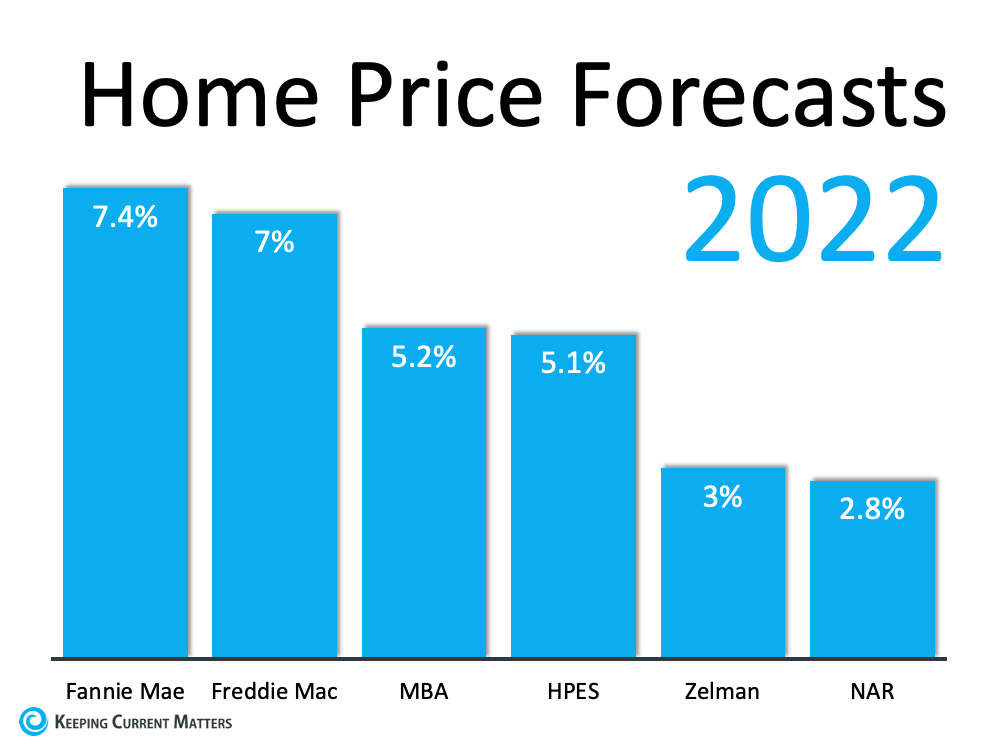

The recent surge in prices is the result of heavy buyer demand and a shortage of homes available for sale. Most experts believe that as more housing inventory comes to market (both new construction and existing homes), the supply and demand for housing will come more into balance. That balance will bring a lower rate of appreciation in 2022. Here’s a look at home price forecasts from six major entities, and they all project future appreciation:

- Fannie Mae

- Freddie Mac

- Mortgage Bankers Association

- Home Price Expectation Survey

- Zelman & Associates

- National Association of Realtors

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

Bottom Line

There have been historic levels of home price appreciation over the last year. That pace will slow as we finish 2021 and enter into 2022. Prices will still rise in value, just at a much more moderate pace, which is good news for the housing market. If you’re considering buying or selling a home, give the Ransom-McKenzie Team a call today to discuss what our local market is doing. We can help you understand at a local level what we’re experiencing in Riverside.

Appraisal Gaps Are Growing

In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors (NAR). The past two homes sold by The Ransom-McKenzie Team sold for over 10% of the asking price. We’re seeing this trend on average for our buyers as well. Shawn Telford, Chief Appraiser at CoreLogic, elaborates:

“The frequency of buyers being willing to pay more than the market data supports is increasing.”

While this is great news for today’s sellers, it can be tricky to navigate if the price of your contract doesn’t match up with the appraisal for the house. It’s called an appraisal gap, and it’s happening more in today’s market than the norm.

According to recent data from CoreLogic, 19% of homes had their appraised value come in below the contract price in April of this year. That’s more than double the percentage in each of the two previous Aprils.

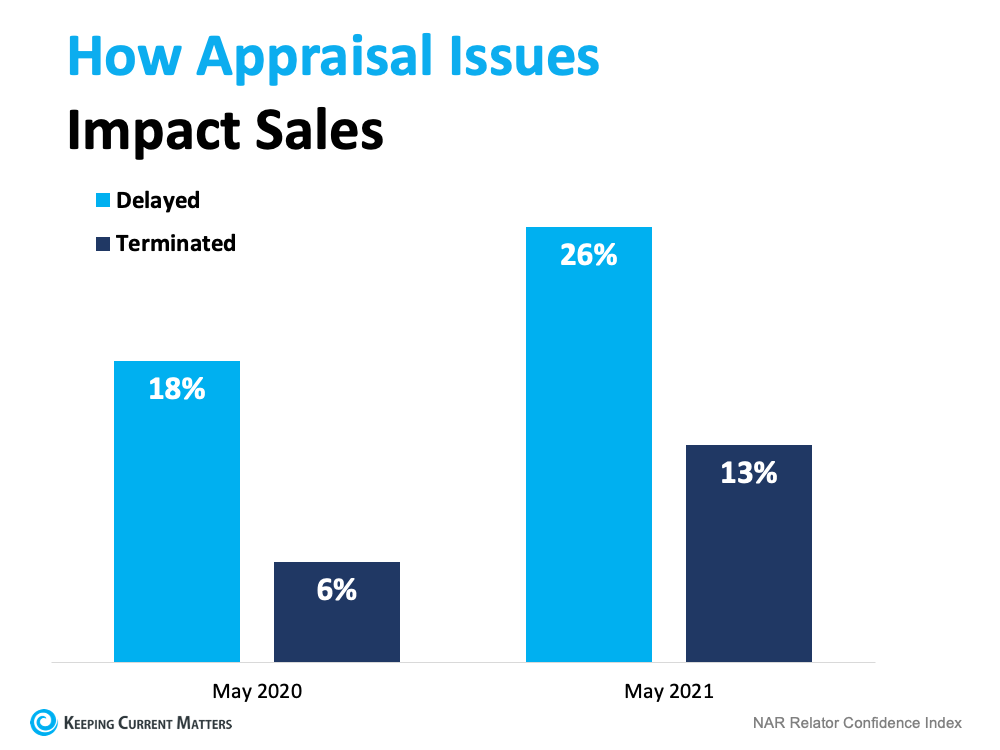

The chart above uses the latest insights from NAR’s Realtors Confidence Index to showcase how often an issue with an appraisal slowed or stalled the momentum of a house sale in May of this year compared to May of last year. If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

In this situation, both the buyer and seller have a vested interest in making sure the sale moves forward with little to no delay. The seller will want to make sure the deal closes, and the buyer won’t want to risk losing the home. That’s why it’s common for sellers to ask the buyer to make up the difference themselves in today’s competitive market. In fact, it has become the norm to waive the appraisal with the offer in order to get it accepted. Many sellers will not even consider an offer without the appraisal being waived.

We are Your Ally

Whether you’re buying or selling, The Ransom-McKenzie Team is your ally. We’re with you throughout the process and are here to help you navigate the unprecedented market we are currently working in. Including potential appraisal gaps. If you’re thinking of buying or selling a home, give us a call today!

Who You Work With Matters

Even in a normal market, it’s good to have an experienced guide coaching you through the process of buying or selling a home. That person can advise you on important things like pricing your home correctly or the first steps to take when you’re ready to buy. However, the market we’re in today is far from normal. As a result, an expert isn’t just good to have by your side – an expert is essential.

Today’s housing market is full of extremes. Mortgage rates hovering near record-lows are driving high buyer demand. On the other hand, an absence of sellers is creating record-low housing inventory. This imbalance in supply and demand is leading to a skyrocketing rate of bidding wars and more houses selling over their asking price. This is driving home price appreciation and gains in home equity. These market conditions aren’t just extreme – they can be overwhelming. Having a trusted expert like The Ransom-McKenzie Team, to coach you through the process of buying and selling a home gives you clarity, confidence, and success through each step.

Here are just a few of the ways a real estate expert is invaluable:

- Contracts – We help with the disclosures and contracts necessary in today’s heavily regulated environment. Contracts are constantly changing, and understanding the disclosures needed for each transaction can be complicated. Make sure you are working with someone who can protect your interests.

- Experience – We’re well-versed in real estate and experienced with the entire sales process, including how it’s changed over the past year.

- Negotiations – We act as a buffer in negotiations with all parties throughout the entire transaction while advocating for your best interests. With over 20 years of experience behind us, we’re ready for any challenge that comes our way.

- Education – We simply and effectively explain today’s market conditions and decipher what they mean for your individual goals. Being intimately familiar with the local market means we are aware of what is happening locally vs national trends. Every market is different.

- Pricing – We help you understand today’s real estate values when setting the price of your home or making an offer to purchase one. If you don’t want to leave money on the table, or miss out on your dream home because you do not know where the market values are going, you’ll want The Ransom-McKenzie Team on your side.

We will be your essential guide through this unprecedented market, but truth be told, not all agents are created equal. A true expert can carefully walk you through the whole real estate process, look out for your unique needs, and advise you on the best ways to achieve success. Finding the right agent should be your top priority when you’re ready to buy or sell a home and the Ransom-McKenzie Team has a proven track record of working with buyers and sellers in Riverside and the surrounding communities.

So, how do you choose the right expert?

It starts with trust. You’ll have to be able to trust the advice your agent is going to give you, so making sure you’re connected to a true professional is key. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in this unique market. As true professional experts we can, however, give you the best possible advice based on the information and situation at hand, helping you make the necessary adjustments and best decisions along the way. The right agent – the professional – will help you plan the steps to take for success, advocate for you throughout the process, and coach you on the essential knowledge you need to make confident decisions toward your goals. That’s exactly what you want and deserve.

The Team For You

It’s crucial right now to work with real estate experts who understand how the market is changing and what that means for home buyers and sellers. In Riverside, that is The Ransom-McKenzie Team. We can answer your questions, give you the best advice, and guide you along the way. We are in the trenches every day, full time, which is what you need most in today’s market. If you’re planning to make a move this year, contact The Ransom-McKenzie Team. We are here to help you.

Historic Custom Home

The Hays-Pattee Home

3611 Mount Rubidoux Drive

In November of 1903, It was discovered that Tom Hays had embezzled over $95,000 from the organization he worked with, the Orange Growers National Bank. He was swiftly arrested, but before his arrest, he spent a portion of what today would be 2.8 Million dollars, on the construction of a home for him and his family, the first home to be built on the slopes of Little Mt. Rubidoux. Like years past, this neighborhood was one of the most prestigious and sought-after neighborhoods in the City of Riverside. Tom and his family never lived in the home, and the scandal that rocked the City of Riverside was all the rage in the social circles for years to come.

Today, the majestic Hays-Pattee house is for sale with The Ransom-McKenzie Team at Coldwell Banker Realty.

Comfortably nestled into the Little Mount Rubidoux hills close to the heart of Riverside with a wonderful view of both the sprawling city of Riverside and the Nature found within the Santa Ana riverbed, this home is still an attention grabber. The scandalous history of the home’s original owner has faded but is not forgotten. Tom Hays was a tall, handsome young man who impressed everyone with his graciousness and friendly manner. He and his family moved to Riverside in 1890. At that time he had little money in his pockets and no name for himself. Over the next 13 years, he managed to move from a small bookkeeping job at the city’s only bank, to become the manager of the city’s biggest bank, owner of important real estate and oil property, and the political boss of Riverside’s Republican party. He was a mover and a shaker in town and no one questioned how he had the means to live his lavish lifestyle on his $200 a month bank salary.

It would seem that Tom’s move to Riverside happened at just the right time. The citrus industry was just beginning to grow, as was the city. This provided the perfect atmosphere for an industrious and charismatic Tom Hays to move up the ranks of the social ladder of Riverside. Over the years he was a leader with the Riverside County Republican Party, was president of the Riverside Chamber of Commerce, Lead the first Elks Club in Riverside, and was known for his singing and musical talent.

Tom’s real estate transactions included 24 acres purchased in the spring of 1902 which was soon graded for grand homes sitting on large lots. As a prominent player in Riverside’s politics, Hays played a major role in the planning of Riverside’s new county courthouse and the first library in town. As a result, he became well acquainted with architects Burnham and Bleisner. It was no surprise when Hays announced his intention to build a house at the top of Little Mount Rubidoux in the local paper in August of 1903, that the architect of choice was Franklin Burnham. Burnham designed a bungalow that would conform to the rocky hillside of the site. The foundations, wide verandas, and fireplace all featured blue and white marble stone from a local quarry. Just as Tom and his family were preparing to move into the home, the local paper announced Tom had resigned as cashier of the bank.

On November 16, 1903, it was discovered that Tom had been skimming money from the Salt Lake Railway with crooked land deals. Then, four months later the discovery of the nearly $100,000 embezzlement from the Orange Growers National Bank became public through a surprise audit of the bank’s records, Tom was arrested for the crime.

Ultimately, the Citizens Bank absorbed the defunct Orange Growers National Bank and few depositors lost their deposits. But what of the magnificent home on the hill? The Hays home, which had completed construction in November of 1904 at a cost of $8,000, was acquired by the bank while Tom was in jail. The bank sold the home to W.P. Lett who was on the board of directors of the defunct bank. In 1908, Lett’s daughter, Lela, and her husband Harry Pattee moved into the home and the home would stay in the Pattee family until Lela’s death in 1968.

Because Tom Hays was so socially prominent when he went about building the house, it is quite welcoming to guests and was designed to entertain. The front door features an original Stickley screen door, a precursor to the feelings of warmth and style Hays likely originally desired the home to have. This “openness” in the center of the house extends from the front of the home well into the back and shows off the natural hardwood floors. In the living room, the stone and clinker brick fireplace is a focal point and the natural hardwood floors, custom wainscoting, continuous plate rails, and iconic egg and dart molding throughout the living space transports you back to a bygone era. The “music” room off of the living room has original wall sconces and ceiling light fixtures, as well as a view looking towards downtown Riverside. The formal dining room has a custom built-in china cabinet and views facing the Santa Ana River and Mount Baldy. The kitchen, which was redesigned when the home was featured as a Riverside Art Alliance “Designer” home, has updated cabinetry, custom tile, and a built-in refrigerator. The large circular bedroom downstairs that was probably the original master bedroom is currently being used as an office.

The second floor was added after the birth of the Patee’s family’s son, William, in 1912 as they needed more space for their growing family. Designed by architect Garrett Van Pelt of Pasadena, this portion of the home blends seamlessly with the original structure and includes antique roof tiles imported from Italy. Today, this floor features leaded glass windows which are in all of the upstairs rooms, and offer views from both sides of the home. A spacious primary bedroom runs the entire width of the home front to back. It also has a ductless mini HVAC unit, which can be expanded to the entire second floor. The walk-in closet of the main second story bedroom is amazing in its sheer size! There are two additional bedrooms and two bathrooms upstairs as well.

The grounds of the home conform to the mountainside with boulders, fountains, grassy knolls, and trees melding together to create a private retreat in the heart of the city. Sitting on the veranda you can hear the water features of the front landscape and relax while enjoying the view of the stately palm trees which lead up the long driveway with the city of Riverside in the background. The back side of the home has a second driveway off of Ladera Lane and a large parking area that could be used for RV storage. You’ll love living in the heart of Riverside’s Downtown Historic neighborhood. Being close to entertainment, shopping, transportation, and Universities is a plus.

Give The Ransom-McKenzie Team a call today if you are interested in this home, or if you’re interested in finding a new place to live in Riverside. For more details regarding this home online, view 3611 Mount Rubidoux Drive on our website.

Riverside’s Sister Cities

The city of Riverside has had International Connections since we established our first sister city relationship with Sendai, Japan over 60 years ago. Riverside has been a leader in Sister City programs ever since. Sister Cities are not unique to Riverside, cities throughout the world have been partnering together since President Eisenhower created the Sister Cities International organization in 1956 which he envisioned being a “hub of peace and prosperity by creating bonds between people from different cities around the world.”

Riverside was one of the first cities to participate with our relationship with Sendai which started in 1957and is the second longest sister city relationship in the United States. Since then, we have established relationships with 8 additional cities which are Cuautla, Mexico (1968), Ensenada, Mexico (1976), Jiangmen, People’s Republic of China (1997), Gangnam, Republic of Korea (1998), Hyderabad, India (2000), Obuasi, Ghana (2008), Erlangen, Germany (2011), and Can Tho, Vietnam (2015).

Through our sister city relationships, the City of Riverside has shared ideas, experiences, and exchanges. Everything from Art Exchange programs with Ensenada, Student exchanges with Erlangen, and marathon runner exchanges with Sendai have been offered through the sister city program. In fact, one of our popular downtown festivals, The Long Night of Arts and Innovation was inspired by a similar festival in Erlangen.

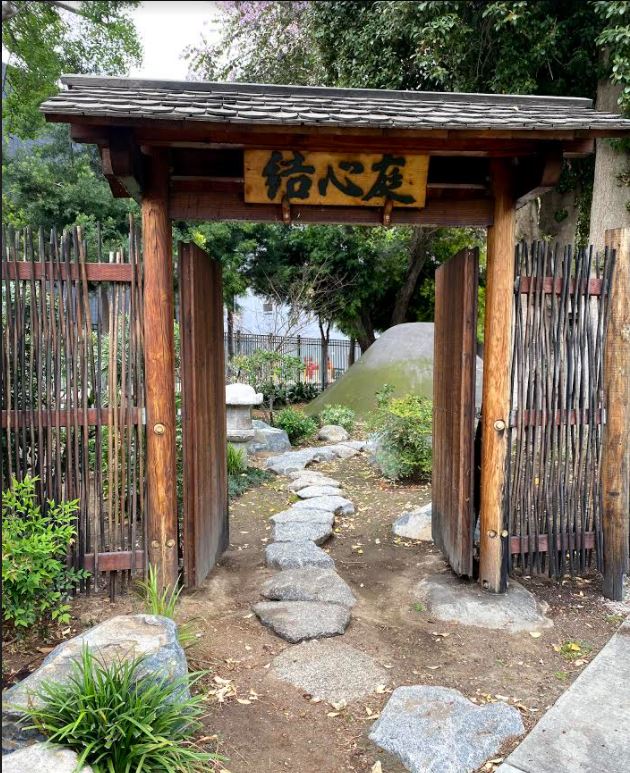

One of our favorite sister city projects is the Yuishin Tei Japanese garden in White Park. This traditional Japanese garden was designed and installed by Japanese master gardeners from Sendai with help of local volunteers from Riverside.

The garden is a wonderful reminder of the strong ties our city has with other countries around the world. The International Relations Council of Riverside, which oversees our sister city relationships, is a great way to get involved and be a part of Riverside’s international connections. For more details, check out ircriverside.org where you can join the IRC as an individual member, or become a corporate sponsor of the programs.